Irs Form 1040 Schedule E Instructions 2024 Calendar – you’ll need to fill out IRS Form 1098, which you should receive from your lender in early 2024. You can then enter the amount from Line 1 on that Form 1098 into Line 8 of 1040 Schedule A. . Stay informed about U.S. taxation for the year 2023. Learn about Form 1040, Schedules, filing deadlines, and essential instructions. Ensure a smooth tax season. .

Irs Form 1040 Schedule E Instructions 2024 Calendar

Source : www.greatland.com1040 (2023) | Internal Revenue Service

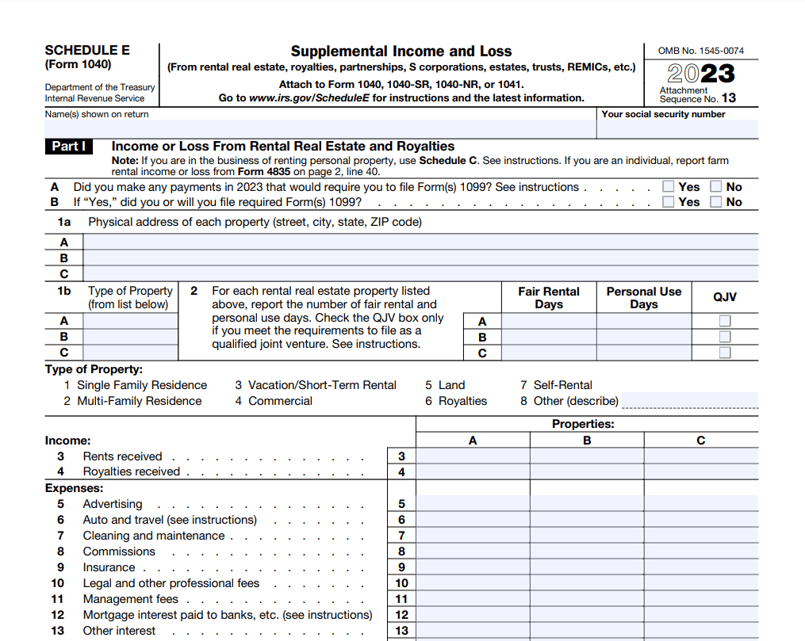

Source : www.irs.govE1204 Form 1040 Schedule E Supplemental Income and Loss (Page 1

Source : www.nelcosolutions.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2023 Instructions for Form 1040 SS

Source : www.irs.govThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.com2023 Instructions for Schedule E

Source : www.irs.govTax season is under way. Here are some tips to navigate it. | ABC27

Source : www.abc27.comWhat Is Schedule E? Here’s an Overview and Summary!

Source : thecollegeinvestor.comIt matters who does a business’ taxes | Tippie College of Business

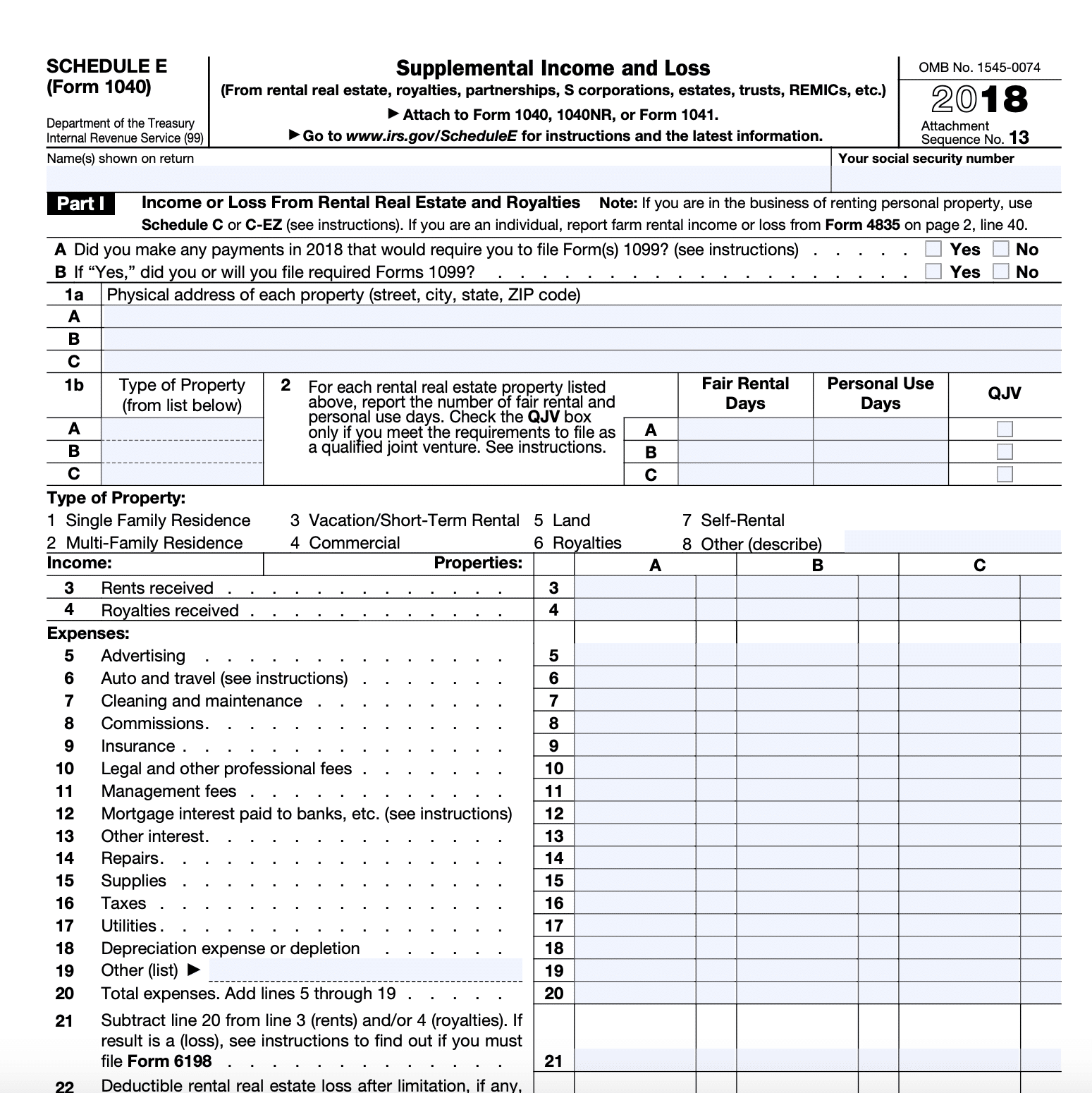

Source : tippie.uiowa.eduIrs Form 1040 Schedule E Instructions 2024 Calendar E1204 Form 1040 Schedule E Supplemental Income and Loss (Page 1 : Start with Adjusted Gross Income (Line 11-IRS Form 1040) add non-taxable interest Click on the “Begin” button and follow the instructions. If you find that your Social Security benefits . Reviewed by Lea D. UraduFact checked by Kirsten Rohrs Schmitt Most taxpayers use Form 1040: U.S. Individual Income Tax Return to file their annual tax returns. Before the tax year 2018 .

]]>